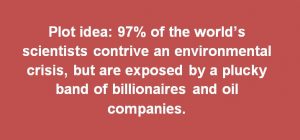

Net zero risks obscuring a lack of action until it is too late.” We must wake up fast to the fact that we are falling for a trick. “They instead plan to continue business as usual while greenwashing their image with tree planting and offsetting schemes that can never ever make up for digging up and burning fossil fuels.

The reality is that corporations like Shell have no interest in genuinely acting to solve the climate crisis by reducing their emissions from fossil fuels. Sara Shaw, Friends of the Earth International, Climate Justice & Energy programme co-coordinator, said: “This report shows that ‘net zero’ plans from big polluters are nothing more than a big con. UN Secretary General and the COP presidency, who are organisers of the next milestone in the UNFCCC process COP26, have already made “net zero” a primary focus despite several recent controversies including the recent backlash against Mark Carney’s initiative. The report was released in a press briefing at 12:30 Amsterdam time during the virtual discussions of the United Nations Framework Convention on Climate Change (UNFCCC). JBS’ commitment to eliminate deforestation in its supply chain by 2035 in effect means it will continue contributing to deforestation for the next 14 years (until 2035), instead of immediately ending the deforestation associated with its supply chain-arguably one of the most effective and quickest ways for JBS to decrease its emissions. But despite pledging in 2020 to sell off most of its fossil fuel shares “in the near future”, it still owns $85 billion in coal assets due to a loophole in its policy. Walmart’s climate plan entirely neglects its value chain emissions, which account for an estimated 95 percent of the corporation’s carbon footprint.Įni is planning on increasing its oil and gas production over the coming years, a feat that the corporation proposes to offset through reforestation schemes that have been described as fake forests.īlackRock, the world’s largest asset manager, has pledged to reach “net zero” emissions in its portfolio by 2050. In one example, Exxon Mobil retained the right to formally review research before it is completed and, in some cases, to plant its own staff on project development teams at Stanford’s Global Climate and Energy Project.īy 2030, Shell alone plans to purchase more offsets to compensate for its emissions every year than were available in the entire global voluntary carbon offset market capacity in 2019. Many activists say the pledges do not go anywhere near far enough.The International Emissions Trading Association, perhaps the largest global lobbyist on market and offsets (both pillars of polluters’ “net zero” climate plans”) has leveraged its outsized presence at international climate talks to advance its agenda over others.Ĭorporations have made massive financial contributions to renowned academic institutions including the Massachusetts Institute for Technology, Princeton University, Stanford University, and Imperial College London to shape and influence the type of “net zero” related research these institutions pursue. Some experts have called the targets a good start and argue that lenders will need to continue working with fossil fuel giants during the energy transition. Those that are members of the United Nations-convened Net Zero Banking Alliance, which includes global banks such as JPMorgan, Deutsche Bank and HSBC, have also begun to announce specific targets for lowering their financed emissions in industries such as oil and gas by 2030. Many banks have committed to a 'Net Zero' 2050 target and several have promised to reduce their direct greenhouse gas emissions, as well as those of their clients, to keep the rise in global temperatures from pre-industrial levels below 1.5 degrees celsius.

"Shareholders should vote against the directors of banks who are hiding their exposure to climate risk." "Any bank making a Net Zero promise whilst actively lobbying against necessary climate regulation – such as mandatory disclosure of borrowers' emissions and climate action plans – is greenwashing," Chris Hohn, the billionaire founder of hedge fund TCI, said in a quote provided by InfluenceMap. One well-known activist investor and climate campaigner said the behaviour amounted to "greenwashing". These policies are designed to boost transparency around financing environmentally harmful activities including fossil fuels.

0 kommentar(er)

0 kommentar(er)